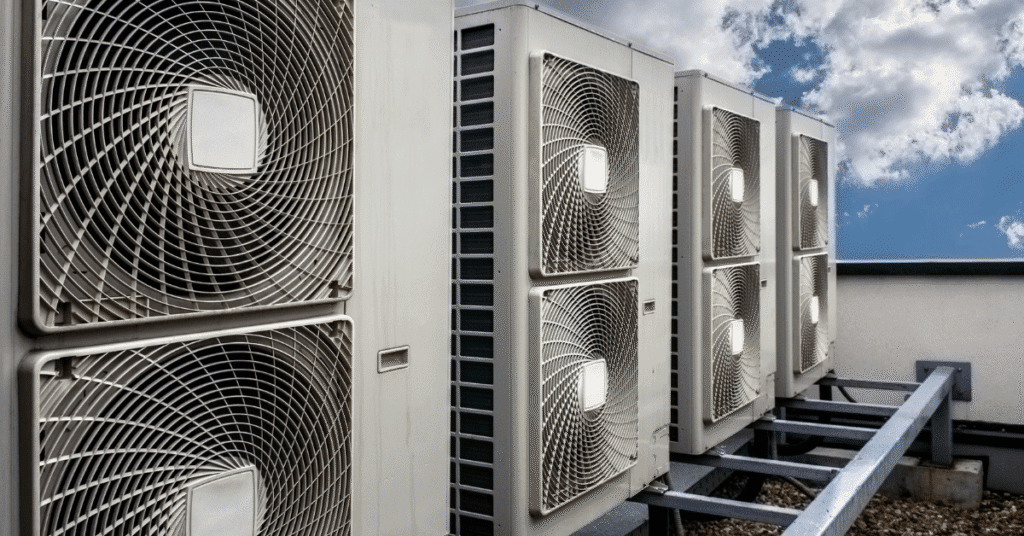

Upgrading your HVAC system is no longer just about comfort it’s also about taking advantage of tax credit opportunities that directly reduce costs while making your home more energy efficient. With the updated federal tax credit for HVAC and other tax incentives, 2025 is one of the best years to consider a new HVAC installation.

In this guide to HVAC tax credits, we’ll cover federal programs, state and utility rebates, eligible equipment, and how to claim the credit properly. Whether you’re considering a heat pump, furnace, or central air conditioners, you’ll see how upgrading can improve home energy efficiency, reduce bills, and provide lasting comfort.

Why Should You Upgrade Your HVAC System in 2025?

Upgrading an outdated heating and cooling system gives you more than comfort it helps you qualify for a tax credit, cut bills, and reduce environmental impact.

Energy Efficiency Standards Are Increasing

In 2025, government rules around the Seasonal Energy Efficiency Ratio (SEER2) mean that HVAC equipment must meet stricter efficiency benchmarks. Choosing a high-efficiency HVAC unit ensures you meet energy requirements and stay ahead of compliance.

Lower Energy Costs and Reduced Footprint

Old systems waste energy, raising monthly bills. Installing ENERGY STAR-certified furnaces, split systems, or heat pumps helps you reduce energy use and qualify for incentives. Furnaces must be ENERGY STAR or meet the consortium for energy efficiency standards to be eligible for credits.

Comfort, Health, and Reliability

Modern HVAC systems provide better airflow, humidity control, and filtration. Regular cleaning, repair, and installation keep your HVAC unit running smoothly, ensuring comfort and healthier indoor air.

What Federal Tax Credits Are Available in 2025?

The federal HVAC tax credit programs for 2025 allow you to recover part of your upgrade costs:

- Energy Efficient Home Improvement Credit (25C): Homeowners can claim a tax credit equal to 30% of eligible property costs and certain energy efficient upgrades. Credit amounts include up to $600 for central air conditioners and $2,000 for a heat pump or heat pump water heater.

- Residential Clean Energy Credit: Often used for solar but also covers geothermal systems, providing a credit equal to 30% of installation costs.

- High-Efficiency Electric Home Rebate Program: Offers rebates of up to $8,000 for air-source heat pumps and thousands more for electrical work.

These energy credits apply directly against taxes owed meaning the credit directly reduces your federal income tax liability.

How Do You Qualify for a Tax Credit?

Not every HVAC system qualifies. To qualify for tax credits, equipment must be ENERGY STAR-certified or meet specific efficiency ratings.

- Furnaces must be energy efficient (95% AFUE or higher).

- Air-source heat pumps and split systems must meet SEER2 requirements.

- Cooling systems like central air conditioners must be energy star certified or energy star-certified packaged systems.

To be eligible for tax credits, homeowners must also keep receipts, documentation, and system model details. This ensures you can claim the federal tax properly when you file your federal income taxes.

What Types of HVAC Systems Are Eligible in 2025?

Credits are available for the following heating and cooling system types:

- ENERGY STAR Most Efficient Central Air Conditioners

- High-Efficiency Furnaces

- Air Source Heat Pumps and air-source heat pump water heaters

- Geothermal HVAC upgrades under the residential clean energy tax credit

By working with a licensed contractor, you’ll know which HVAC upgrades are eligible to claim a credit.

How Much Credit Can You Claim?

The credit amounts depend on the system:

- Up to $2,000 rebate for heat pumps

- Up to $600 rebate for central air conditioners

- Credit equal to 30% of costs and certain energy efficient installations

- Claim the maximum annual credit every tax year for multiple improvements

The credit applies only if the system must be ENERGY STAR or meet required efficiency standards. Always confirm eligibility before purchase.

Can You Combine Federal and State Rebates?

Yes, you can. Many states and utilities encourage cost-effective energy efficiency improvements:

- Idaho Power Energy Efficiency Program: Rebates for ductless mini-splits, heat pumps, and furnaces.

- Rocky Mountain Rebates: Savings on high-efficiency HVAC systems.

- Local Utility Rebates: Seasonal offers for residential energy upgrades.

By combining federal tax credit for HVAC with local rebates, you can maximize savings on HVAC upgrades.

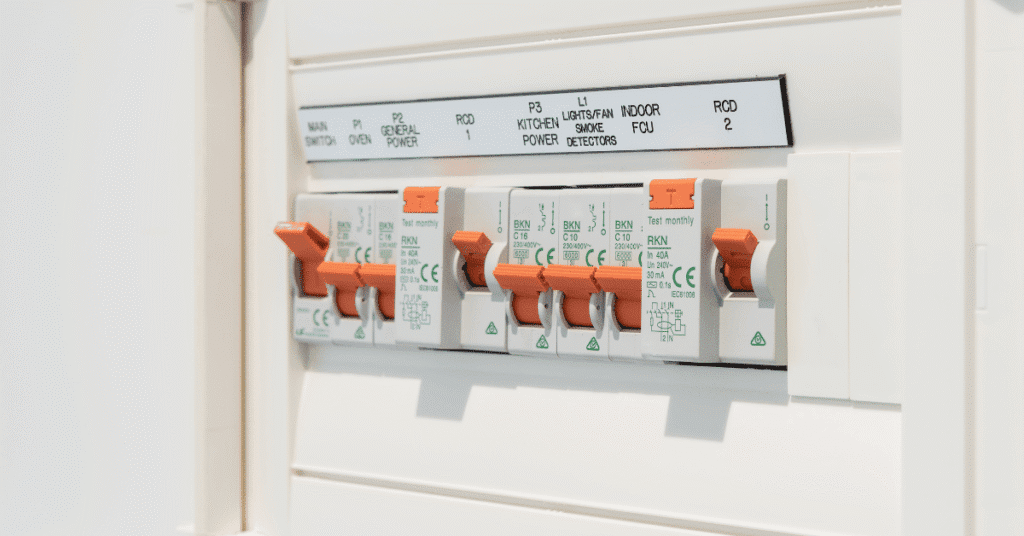

How to Claim the Credit on Your Tax Return

The IRS makes the process simple if you prepare:

- Keep invoices for installation, receipts, and system documentation.

- Confirm the system must be energy star certified.

- Complete IRS Form 5695 to claim the credit.

- File your federal income taxes and ensure compliance.

- Consult a tax professional to avoid errors and ensure you claim an energy efficient home credit properly.

Cost vs. Savings Example

| HVAC Upgrade | Installation Cost | Federal Credit | Local Rebate | Net Cost | Annual Savings | 5-Year Savings |

| Heat Pump | $9,000 | $2,000 | $1,000 | $6,000 | $800 | $4,000 |

| Central AC | $6,500 | $600 | $500 | $5,400 | $400 | $2,000 |

This demonstrates how income tax credits are available to reduce upfront expenses and create long-term savings.

Common Questions About HVAC Tax Credits

Do landlords qualify? Yes, you can claim a credit if you’re a landlord who installs eligible systems.

Can you get more credit than you owe? In most cases, you can’t receive back more on the credit than you owe, but credits roll over.

What if I installed my system in 2023? If installed after Jan 1, 2023, you may still qualify for a tax credit in the 2025 tax year.

Are all homeowners eligible for a tax credit? Yes, but systems must be energy star-certified and meet efficient home improvement tax credit requirements.

Why Work With a Professional Installer?

Upgrading HVAC isn’t just about buying equipment. Proper installation, repair, and cleaning are key to getting full value. A professional contractor ensures:

- The system qualifies for the federal HVAC tax credit

- Equipment is installed to maximize energy efficiency

- Guidance on credit you can claim and advantage of tax credits

- Reliable service, repair, and maintenance for long-term use

By working with experts, you ensure cost-effective energy efficiency improvements and avoid missing out on available benefits.

Conclusion

The guide to HVAC tax credits for 2025 highlights why this is a prime year to upgrade your heating or cooling system. With the federal tax credit, energy efficient home improvement credit, and residential clean energy credit, homeowners can drastically cut upgrade costs. Add in rebates from local programs, and the savings become even more attractive.

A new HVAC installation not only lowers bills but also ensures your home remains comfortable year-round while supporting significant and cost-effective energy efficiency improvements.